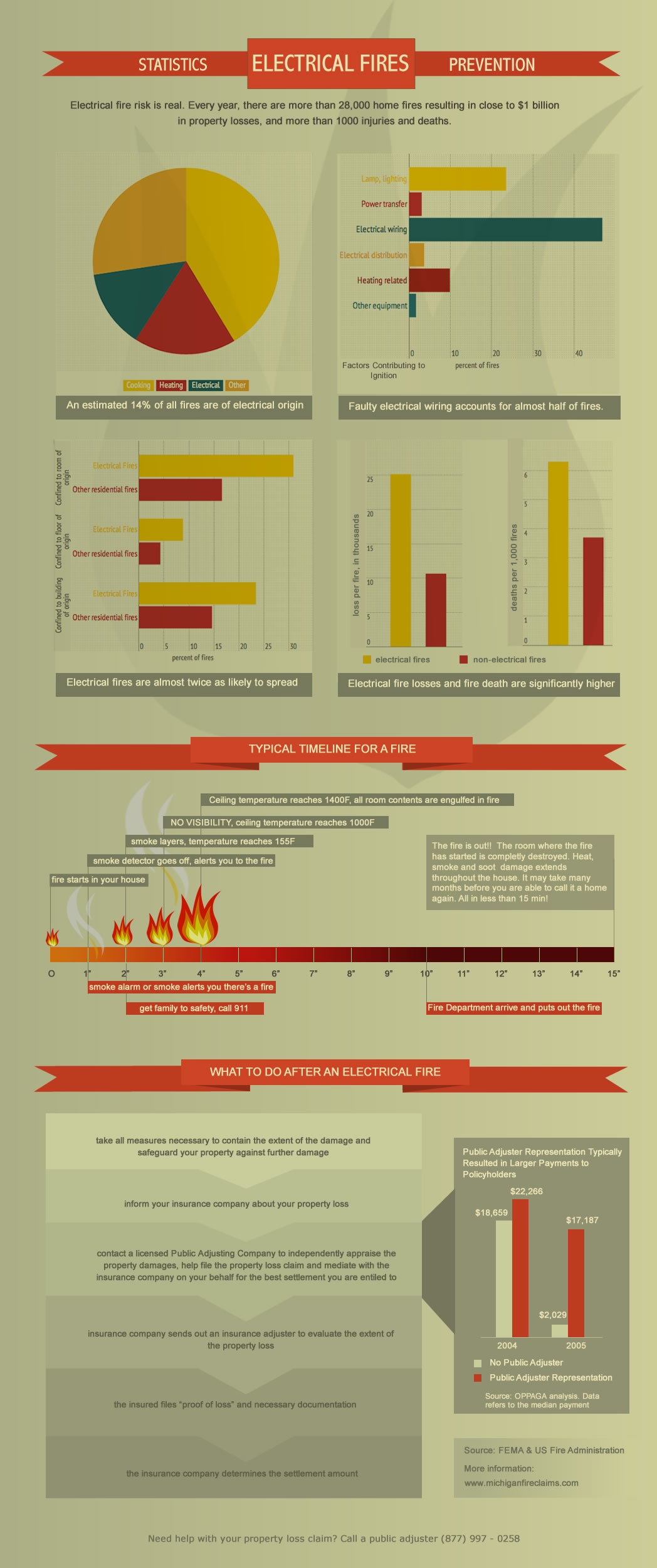

Winter Fire Safety

With the winter and the Holiday Season already here, most of us look forward to spending those moments with family and friends, in warm homes with lit up trees and home cooked food. Sadly, for some, this holiday season will not be fondly remembered...